Portfolio Backtest Example¶

This example shows how to write and execute a PortfolioBacktest

Python source code: ../../examples/portfolio_backtest.py

import boatwright

from boatwright.Data.Collection.Historical import AlpacaCollector

from boatwright import PortfolioBacktest

from boatwright.Brokers import BacktestBroker

from MACD import MACD

from datetime import datetime

import matplotlib.pyplot as plt

# 1. Define the Strategy and portfolio split

strategy = MACD(fast_period=7, slow_period=14, symbol=None)

symbols = ["AAPL", "MSFT", "GOOGL", "AMZN", "AMD", "NVDA", "INTC"]

split_dict={"AAPL":.1, "MSFT":.1, "GOOGL":.1, "AMZN":.1, "AMD":.2, "NVDA":.2, "INTC":.2} # split_dict must sum to 1 or less

# 2. If you haven't already, collect the historical data:

start = datetime(year=2024, month=1, day=1, hour=1, minute=0)

end = datetime(year=2025, month=1, day=1, hour=1, minute=0)

granularity_unit="DAY"

collector = AlpacaCollector()

database = boatwright.Data.CSVdatabase(source="ALPACA", debug=False)

for sym in symbols:

data = collector.collect(sym, start, end, granularity_unit, verbose=True) # retrieves data via Alpaca API

database.save(sym, data, granularity_unit, verbose=False) # saves data as .csv files

# 3. load and organize the data into a dict

data_dict = {}

for sym in symbols:

data_dict[sym] = database.load(symbol=sym, start=start, end=end, prerequisite_data_length=strategy.calc_prerequisite_data_length(), granularity=1, granularity_unit=granularity_unit, verbose=False)

# 4. Instatiate and run the PortfoilioBacktest

broker=BacktestBroker(taker_fee=0, maker_fee=0, slippage=0, quote_symbol="USD", starting_aum=1000)

portfolio = PortfolioBacktest(data_dict, strategy_dict=strategy, broker_dict=broker)

portfolio.divide_portfolio(split_dict=split_dict, starting_aum=10000)

portfolio.run(verbose=True)

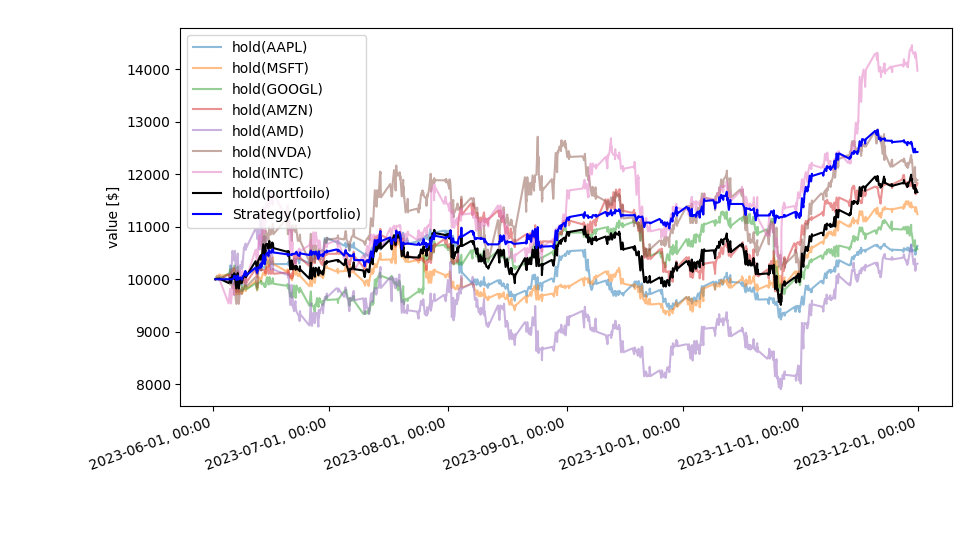

# 5 Analyze results

boatwright.Visualization.plot_portfolio(portfolio)

plt.show()