Active Optimization Example¶

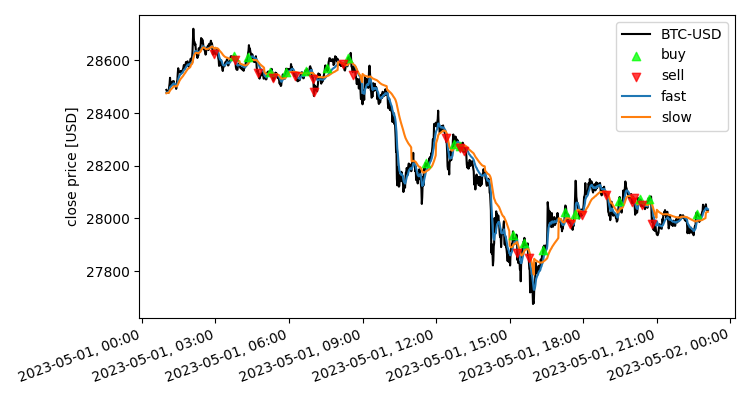

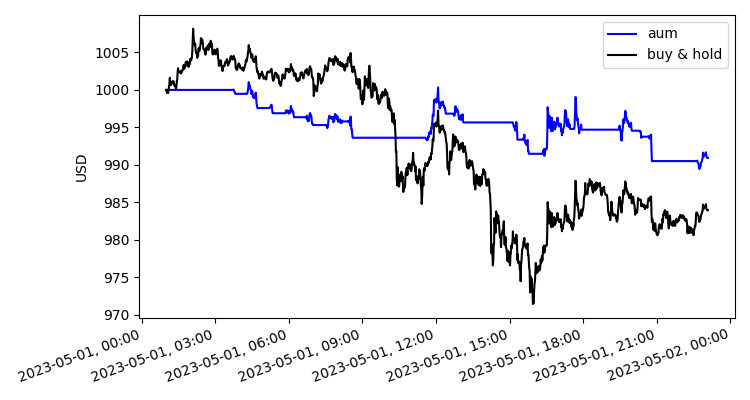

set the example MACD strategy to periodically run a parameter scan on the most recent data, and update the parameters acccordingly

Python source code: ../../examples/active_optimization.py

from boatwright.Data import CSVdatabase

from boatwright import Backtest

from boatwright.Brokers import BacktestBroker

from boatwright.Visualization import plot_backtest

from boatwright.Optimizations.ParameterScan import ParameterScan

from boatwright.Optimizations.Optimization import generate_parameter_combinations

from boatwright import ActiveOptimization

from boatwright.BacktestExecutors import ParallelExecutor

from boatwright.PerformanceMetrics import PercentProfit

from MACD import MACD

from datetime import datetime

import matplotlib.pyplot as plt

# 1. set the boker model

br = BacktestBroker(taker_fee=0, maker_fee=0, slippage=0.1, quote_symbol="USD")

# 2. set the strategy, and optimization (in this example a parameter scan)

macd = MACD(symbol="BTC", fast_period=1, slow_period=2)

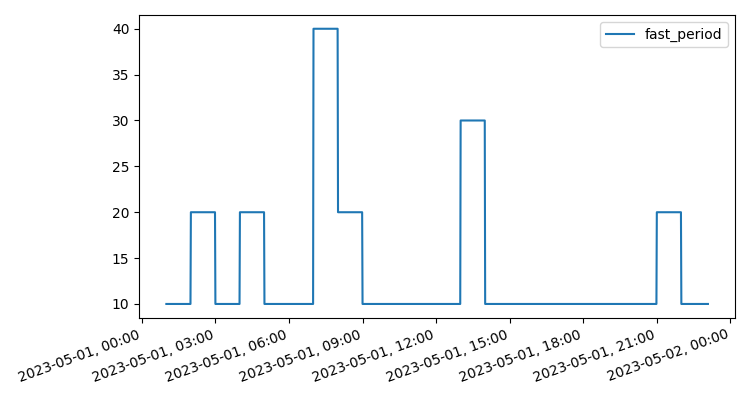

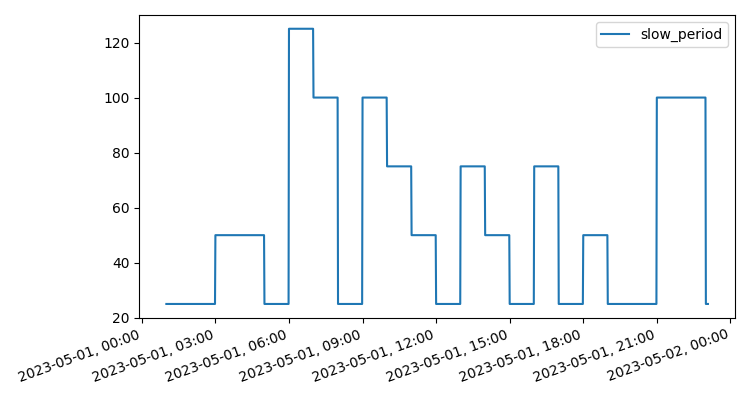

scan = {

"fast_period": [10,20,30,40,50],

"slow_period": [25,50,75,100,125]

}

parameters_sets = generate_parameter_combinations(scan)

parameters_sets = [p for p in parameters_sets if (p["fast_period"] < p["slow_period"])]

loss_function = lambda b: -PercentProfit().calculate(b) # by minimizing 'negative' percent profit, profit is maximized

executor = ParallelExecutor(n_procs=3)

ps = ParameterScan(strategy_class=MACD, symbol="BTC", broker=br, loss_function=loss_function, scan=parameters_sets, data=None, executor=executor)

ps.make_backtests()

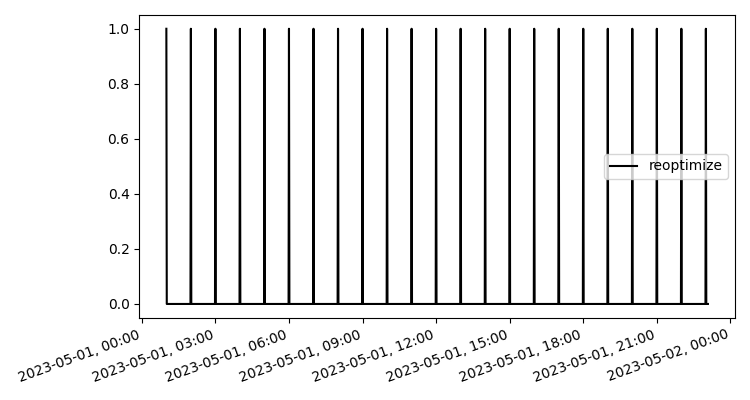

# 3. declare the ActiveOptimzation

# In this example: optimize every day, using the most recent 5 days of data

strategy = ActiveOptimization(strategy=macd, optimization=ps, opt_period=24*60, opt_length=5*24*60, debug=False, verbose=True)

# 4. load data for the backtest

DB = CSVdatabase(source="ALPACA", dir="quickstart_data/")

start = datetime(year=2024, month=1, day=1, hour=1, minute=0)

end = datetime(year=2024, month=2, day=1, hour=0, minute=0)

data = DB.load(symbol=strategy.symbol, start=start, end=end, prerequisite_data_length=ps.calc_prerequisite_data_length(), granularity=1, granularity_unit="MINUTE")

# 5. run the backtest

backtest = Backtest(strategy=strategy, data=data, broker=br, debug=False)

backtest.run(verbose=True)

# analyze results

plot_backtest(backtest)

plt.show()