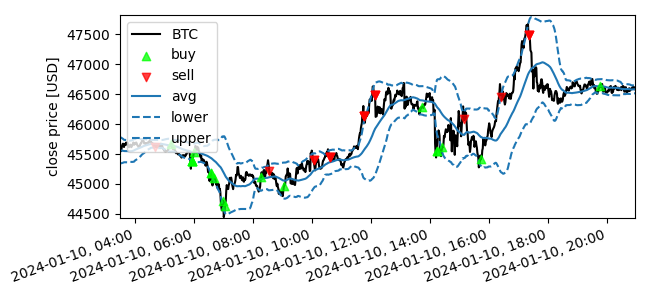

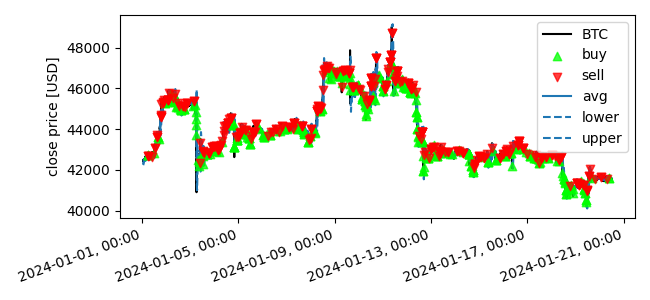

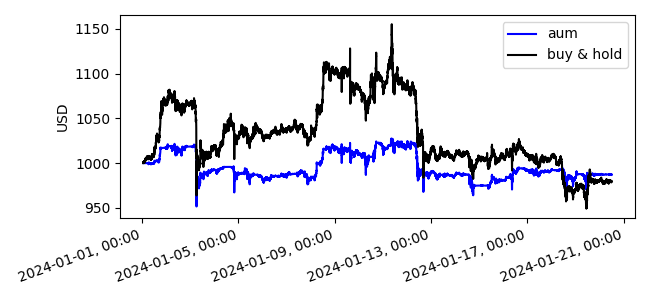

Bollinger Bands Example¶

This example shows how to write an example bollinger bands strategy, and execute a backtest of it

Python source code: ../../examples/bollinger_bands.py

from boatwright import Strategy, Backtest

from boatwright.Data import CSVdatabase

from boatwright.Brokers import Broker, BacktestBroker

from boatwright.Orders import MarketOrder, TrailingOrder

from boatwright.Indicators import bollinger_bands, crossover

from boatwright.Visualization import plot_backtest

from datetime import datetime, timedelta

import matplotlib.pyplot as plt

class BollingerBands(Strategy):

"""

An example strategy using Bollinger Bands (BB) as a technical indicator and Trailing Orders

"""

def __init__(self, period:int=7, std_devs:int=2, symbol:str="BTC", strategy_id="BollingerBands"):

super().__init__(symbol, strategy_id)

self.p["period"] = period

self.p["std_devs"] = std_devs

self.position = False

def calculate_signals(self, df):

df["avg"], df["lower"], df["upper"] = bollinger_bands(df["close"], period=self.p["period"], n_std_dev=self.p["std_devs"])

df["buy_trigger"] = crossover(df["close"], df["lower"])

df["sell_trigger"] = crossover(df["close"], df["upper"])

return df

def calc_prerequisite_data_length(self):

return self.p['period']

def step(self, row):

buy_trigger = row["buy_trigger"]

sell_trigger = row["sell_trigger"]

datetime = row["datetime"]

price = row["close"]

if buy_trigger == -1:

market_buy = MarketOrder(symbol=self.symbol, side="BUY", frac=0.5)

# This trailing orders will execute the market order when the price increases 1% with respect to the minimum price (since order placement)

# This should help avoid entering a trade if the price is continueing to swing down

buy_order = TrailingOrder(market_buy, price=price, pct_greater_than_min=0.25, time_in_force=datetime+timedelta(minutes=30))

self.broker.place_order(buy_order)

if sell_trigger == 1:

market_sell = MarketOrder(symbol=self.symbol, side="SELL", frac=0.5)

# This trailing orders will execute the market order when the price decreases 1% with respect to the maximum price (since order placement)

# This should help avoid exiting a trade if the price is continueing to swing up

sell_order = TrailingOrder(market_sell, price=price, pct_less_than_max=-0.25, time_in_force=datetime+timedelta(minutes=30))

self.broker.place_order(sell_order)

def plot_info(self):

info = {

"avg": {"ax_n": 2, "color":"C0", "linestyle":"-"},

"lower": {"ax_n": 2, "color":"C0", "linestyle":"--"},

"upper": {"ax_n": 2, "color":"C0", "linestyle":"--"},

"buy_trigger": {"ax_n": 3, "color":"lime"},

"sell_trigger": {"ax_n": 3, "color":"red"},

}

return info

# -------------------------------------------------------

# 1. define the strategy

strategy = BollingerBands(period=60, std_devs=2, symbol="BTC")

# 2. load data for the backtet (including prequisite data for necessary for signal generation)

database = CSVdatabase(source="ALPACA", debug=False, dir="quickstart_data/")

start = datetime(year=2024, month=1, day=1, hour=1, minute=0)

end = datetime(year=2024, month=1, day=20, hour=12, minute=0)

data = database.load(symbol=strategy.symbol, start=start, end=end, prerequisite_data_length=strategy.calc_prerequisite_data_length(), granularity=1, granularity_unit="MINUTE", verbose=True)

# 3. declare and run the backtest

broker_model = BacktestBroker(taker_fee=0, maker_fee=0, slippage=0, quote_symbol="USD")

backtest = Backtest(strategy=strategy, data=data, broker=broker_model, debug=False)

backtest.run(verbose=True)

# 4. analyze results

plot_backtest(backtest)

plt.show()