Backtest Example¶

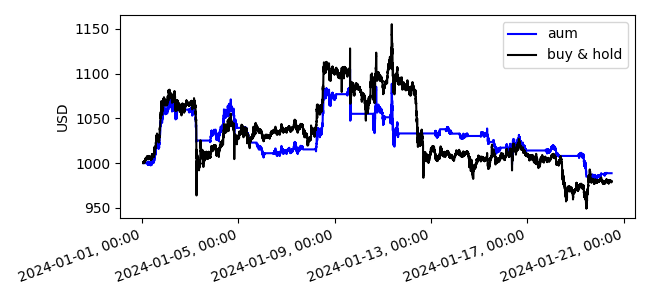

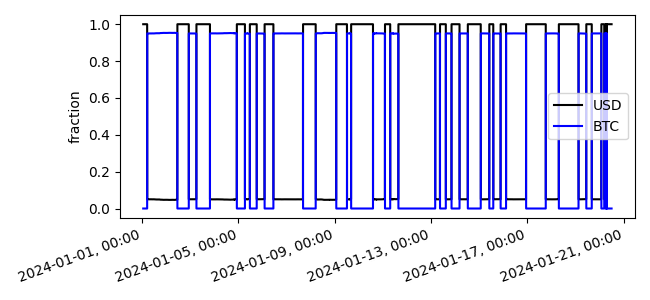

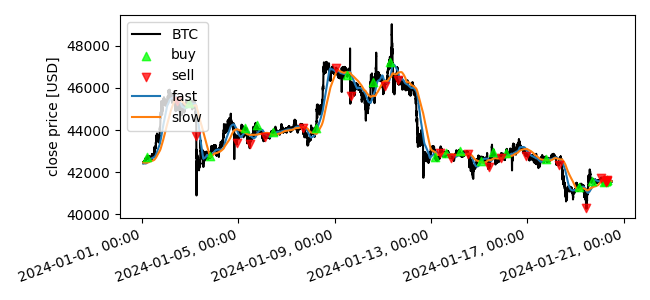

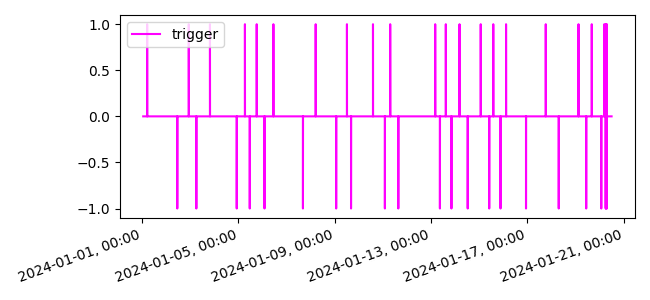

This example executes a backtest of the Strategy Example against BTC data. For details regarding how figures were generated see the Plot Backtest routine.

Python source code: ../../examples/backtest.py

import boatwright

from MACD import MACD

from boatwright.PerformanceMetrics import ROI, PercentProfit, SharpeRatio

from datetime import datetime

import matplotlib.pyplot as plt

# 1. define the backtest broker model

broker = boatwright.Brokers.BacktestBroker(taker_fee=0.1, maker_fee=0.1, slippage=0, quote_symbol="USD")

# 2. define the strategy

strategy = MACD(fast_period=7*60, slow_period=14*60, symbol="BTC")

# 3. load data for the backtet (including prequisite data for necessary for signal generation)

database = boatwright.Data.CSVdatabase(source="ALPACA", debug=False, dir="./quickstart_data")

data = database.load(

symbol=strategy.symbol,

start=datetime(year=2024, month=1, day=1, hour=0, minute=0),

end=datetime(year=2024, month=6, day=1, hour=0, minute=0),

prerequisite_data_length=strategy.calc_prerequisite_data_length(),

granularity=1, granularity_unit="MINUTE",

verbose=True

)

print(data)

# 4. declare and run the backtest

backtest = boatwright.Backtest(strategy=strategy, data=data, broker=broker, debug=False)

backtest.run(verbose=True)

# 5. analyze results

print(f"ROI: {ROI().calculate(backtest)}")

print(f"Percent Profit: {PercentProfit().calculate(backtest)}")

print(f"Sharpe Ratio: {SharpeRatio().calculate(backtest, risk_free_rate=0, increments_per_year=365*24*60)}")

boatwright.Visualization.plot_backtest(backtest)

plt.show()