Parameter Scan Example¶

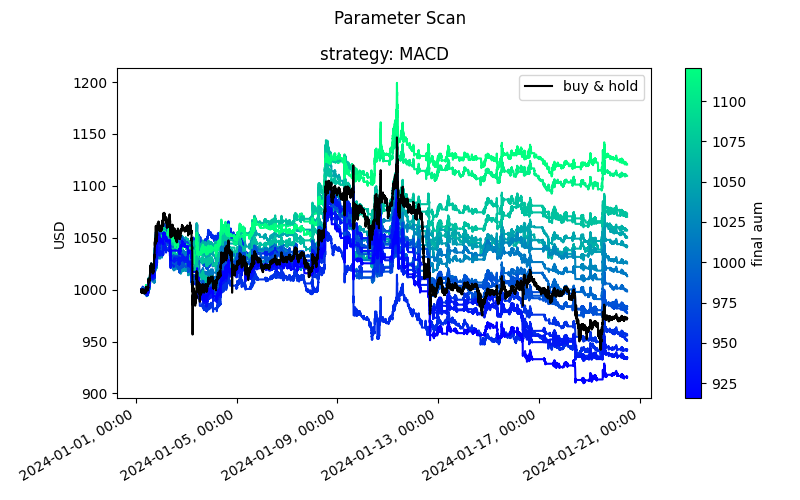

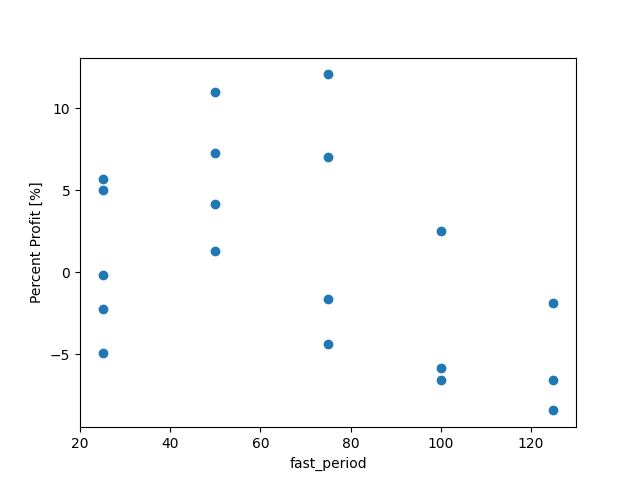

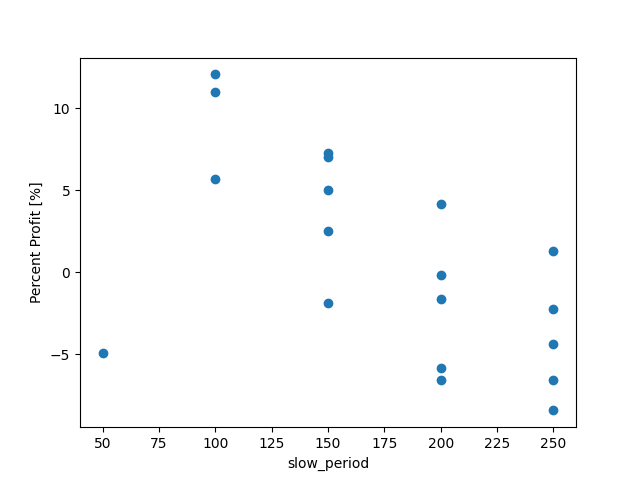

This example executes a parameter scan of the fast and slow periods in the example MACD strategy

Python source code: ../../examples/parameter_scan.py

import boatwright

from boatwright.Optimizations import generate_parameter_combinations, ParameterScan

from boatwright.PerformanceMetrics import PercentProfit

from MACD import MACD

from datetime import datetime

import matplotlib.pyplot as plt

# 1. define the strategy and broker model, load data

# broker = boatwright.Brokers.BacktestBroker(taker_fee=0, maker_fee=0, slippage=0, quote_symbol="USD")

broker = boatwright.Brokers.BacktestBroker(taker_fee=0.004, maker_fee=0.006, slippage=0, quote_symbol="USD")

symbol="BTC"

database = boatwright.Data.CSVdatabase(source="ALPACA", debug=False, dir="quickstart_data/")

start = datetime(year=2024, month=1, day=1, hour=1, minute=0)

end = datetime(year=2024, month=1, day=20, hour=12, minute=0)

data = database.load(symbol=symbol, start=start, end=end, granularity=1, granularity_unit="MINUTE", verbose=True)

# NOTE: for each backtest data will be trimmed off the start of this data chunk such that each backtest (which have different prerequisite data requirements) is across the same date/time range

# 2. generate a list of parameters combinations to scan

scan = {

"fast_period": [25,50,75,100,125],

"slow_period": [50,100,150,200,250]

}

parameters_sets = generate_parameter_combinations(scan)

# for MACD remove scenarios where fast_period >= slow_period:

parameters_sets = [p for p in parameters_sets if (p["fast_period"] < p["slow_period"])]

# 3. declare the parameter scan, initialize data, and run

loss_function = lambda b: -PercentProfit().calculate(b) # by minimizing the negative percent profit, profit is maximized

parameter_scan = ParameterScan(strategy_class=MACD, symbol=symbol, broker=broker, loss_function=loss_function, scan=parameters_sets, data=data)

parameter_scan.make_backtests() # creates a backtest for each parameter combination

optimal_strategy = parameter_scan.run(verbose=True)

print("Optimal Parameters: ", optimal_strategy.p)

# 4. analyze results

boatwright.Visualization.param_scan_stack_aum(parameter_scan)

boatwright.Visualization.param_scan_1D(parameter_scan, parameter="fast_period", performance_metric=boatwright.PerformanceMetrics.PercentProfit())

boatwright.Visualization.param_scan_1D(parameter_scan, parameter="slow_period", performance_metric=boatwright.PerformanceMetrics.PercentProfit())

plt.show()